Private ICE contractor stock surged after Trump was elected, then tanked. Wall Street is facing losses due to protests and activism as well as government failure to satisfy private investor interests

Early in Donald Trump’s administration (after the 2024 election), private prison stocks likeGEO Groupand CoreCivic climbed sharply because markets priced in expectations of massive expansion of ICE detention contracts and deregulation. This boosted future revenue expectations. However, in the months that followed, organization lagged, ICE agents were not hired as fast as expected and the actual revenue ramp-up didn’t materialize as quickly as investors hoped, and its hyped stock prices declined from those peaks: GEO was trading around $36 near the start of 2025 and dropped to around $16 by late 2025 and early 2026.

Key Reasons for the Decline / Softening

Expectations vs. Reality:

Investors priced in a yuuge surge, biggest surge in the world -in trumpspeak- in ICE contracts including new detention beds, deportation enforcement, and expanded surveillance programs but government did what government does and budget and contracting timelines lagged from start to current day. Some funding proposals remain tied up in Congress, delaying payouts.

Revenue Growth Has Been Real but Not Enough

Even though for example mass incarcerators with ICE contracts GEO Group and CoreCivic reported some revenue and net income increases recently, analysts still saw flatter long-term earnings trends and weakening margins, which dampens stock valuations.

Market & Credit Pressures

Private prison companies historically lost access to financing from major banks due to activist pressure and credit concerns, which can raise borrowing costs and lower investor confidence.

Political & Policy Uncertainty

Obama and Biden administrations previously tried to roll back private prison use somewhat, though Trump reversed many of those policies. Policy shifts created Wall Street uncertainty about future government contracting. Some legislative proposals (e.g., large detention funding bills) still haven’t fully passed, so the expected revenue bumps are still delayed.

Divestment & ESG Headwinds

There’s currently a powerful divestment movement by pension funds and socially responsible investors in private prison stocks, which pressures share prices over time as institutions sell holdings.

Investor Sentiment Cycles

Stocks overshot when news hits (such as the Trump election victory) and then re-priced once earnings and cash flows were assessed more realistically, especially when anticipated “boom” revenue takes time to arrive.

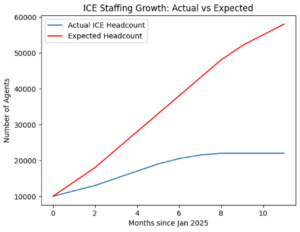

ICE hiring, before and now, and what is planned

Baseline before the ramp: Government Executive reports ICE employed about 10,000 officers and agents when Trump took office last year, meaning early 2025. That same report says ICE now employs more than 22,000 officers and agents, after onboarding about 12,000 new hires. ICE reportedly sorted through more than 220,000 applicants and offered large signing bonuses, with direct hire authority and other accelerators. ICE planned a $100 million recruiting blitz and the reporting described funds to hire about 14,000 new employees.

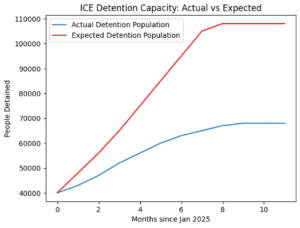

Detention Space

ICE has been running near the ceiling while trying to expand, and the expansion has not kept up with the political targets. The American Immigration Council report says when Trump took office in January 2025, roughly 40,000 people were in immigration detention, and by the end of December it was more than 68,000, with the system reportedly capable of holding about 70,000 on a given day. That report also says leaked plans originally hoped to have nearly 108,000 detention beds online by January 2026, and that the administration did not meet that goal. Their stated 2026 goal is 107,759 people in detention.

What private prison companies did to add beds

Brennan Center reported GEO reactivated four facilities totaling about 6,600 beds for ICE and that both GEO and CoreCivic were moving to reopen idle facilities and add beds.

So why are they still lagging on mass deportation execution?

The constraints are not one thing. It is a whole chain.

Not enough detention space at the moment the government needs it

Axios reported early in the second term that lack of detention space, officers, funds, and infrastructure made one million deportations in a year unrealistic, and that detention units holding about 41,500 people a day were nearly at capacity at that point in time. Government Executive says DHS shortened training for ICE agents from six months to around six weeks, and that the federal training center curtailed operations for non ICE personnel to prioritize ICE recruits. That is a sign of a system, ready or not, trying to ram through delivery at any cost, not a system that is comfortably scaling.

Court and case system bottlenecks

Migration Policy Institute notes the removal case backlog is almost 4 million, and that expedited removal expansions are being challenged in court. Even if enforcement arrests rise, removals can be throttled by adjudication capacity and litigation risk.

Removal flights and logistics do not scale instantly

Even when you have planes, you still need staging, detention transfer capacity, destination country coordination, staffing, and schedules. The fact that airlines like Avelo are exiting deportation flying shows reputational and contracting friction can hit the flight layer too. Cities have been under direct activist pressure to stop hosting Avelo privatized deportation flights and cities are pulling back under pressure.

They missed the public year one target and Wall Street is unforgiving

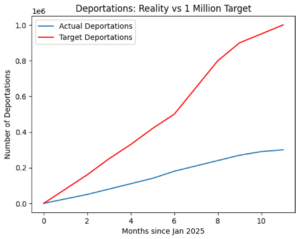

The Guardian report says the administration was far below the one million deportations goal in the first year, with about 300,000 removals since the second inauguration, despite record detention levels.

This is known on Wall Street as a classic, almost textbook failure mode with the failing revenue engine being the federal government. It is an expectation gap trade, to use Wall Street language for the profit shortcomings in the business with human misery. After Trump’s election, a policy-driven multiple expansion occurred followed by compression due to the government underdelivering what had been promised by Trump as part of the campaign promises of mass deportation to start “from Day 1.” Congress unflinchingly even approved the Big Beautiful Bill and its giant deportation budget, but it did not turn into cash flow on schedule. Wall Street priced these stocks as if deportation were a frictionless commodity. It turned into a system failure.

Investors bet billions on the efficiency of a federal bureaucracy to rapidly industrialize deportation at scale. What they got instead was the same thing the government always delivers: hiring delays, training bottlenecks, bed shortages, court backlogs, missed targets and increased difficulty carrying out mass deportations in the face of massive protests.

Where activists won, Wall Street lost

There are real, concrete cases where activism and protests have directly cost companies revenue or contracts in the deportation ecosystem. Here’s the cleanest list I can support with sources right now.

Air deportation and the charter flight ecosystem

Avelo Airlines and activist pressure

What activists hit: the airline itself, its commercial bases, and airport relationships.

What changed: Avelo announced it will stop flying ICE deportation charters and close its Mesa Gateway Arizona base tied to the program on January 27, 2026. Multiple reports describe sustained protests, boycott campaigns, and political pressure as part of the controversy around the contract.

Revenue impact signal: Avelo’s CEO and coverage described the ICE charter work as not delivering enough consistent revenue and carrying heavy reputational costs. Activism tied to additional pullbacks: reporting described boycotts and protests around bases, including base closures and retrenchment from some markets while the ICE controversy swirled.

GlobalX Airlines and Eastern Air Express and activist pressure

What activists hit: state and local officials plus public pressure campaigns around specific airports.

What changed so far: Massachusetts Governor Maura Healey publicly called on GlobalX and Eastern Air Express to stop ICE charter flights out of Hanscom Field, framing it as profiting off practices that obstruct access to counsel and due process. Revenue losses are on the horizon. We have not seen confirmed reporting yet that either airline actually terminated ICE flying because of this pressure, so I’m treating this as active pressure, not a proven revenue loss as of January 15, 2026.

Local jails and cities rented detention space to ICE. And then came protesters

City of Glendale, California:

What activists hit: the city’s contract and political leadership.

What changed: Glendale terminated its agreement to house ICE detainees at the city jail after public scrutiny and pressure, with officials describing the contract as divisive and pointing to community trust issues. Revenue loss: this is a direct loss of a detention holding revenue stream for the city and the local facility operation.

Detention expansion and detention support contracting meets tribal activism

Prairie Band Potawatomi Nation subsidiary design contract:

What activists hit: the tribe’s internal governance and reputational risk.

What changed: Tribal Business News reported the Prairie Band Potawatomi Nation fired senior executives after outcry over a tribal subsidiary winning a federal contract to design potential ICE detention facilities, saying it did not align with tribal values.

Revenue impact: the reporting frames this as a major internal backlash event that disrupted leadership and the direction of that line of business, even if the underlying federal award existed.

Finance and capital markets

Big banks exiting private prison financing:

What activists hit: lenders and institutional reputational risk, which then hit GEO and CoreCivic’s cost of capital.

What changed: multiple major banks announced they would stop financing private prison companies, after sustained activist and stakeholder pressure. Reuters and other reporting from 2019 documents the wave and the rationale.

Revenue impact: this usually shows up as higher financing costs, fewer lending options, and more fragile expansion math, rather than a clean “lost contract” headline.

Recruiting, media, and ad tech

Spotify ending ICE recruitment ads

What activists hit: brand and platform ad policy reputational pressure.

What changed: The Guardian reported Spotify is no longer running ICE recruitment ads after the government campaign ended, with activist and artist backlash around the ads highlighted in the coverage.

Revenue impact: this is best described as disrupted distribution and reputational friction rather than a clear dollars figure, because the campaign ending is also part of the story.

Hotels and Lodging

Hotels and lodging disruptions for ICE agents are in the news, but those are not clearly part of the deportation contractor revenue chain in the same way, and the facts are not easily quantifiable in terms of direct known revenue losses.

The deportation industry was built on cruelty and lots of funding. It failed because it depended on the government to execute on a fantasy MAGA timeline.

What collapsed wasn’t the appetite for deportation. It was the illusion that a slow, litigious, understaffed federal bureaucracy could deliver cruelty on a venture-capital schedule. Wall Street sold itself a story about mass deportation as a growth industry, then rediscovered the oldest rule in Washington economics: appropriations are not execution.

Summary by IncarcerNation.com

SOURCE LINKS:

https://www.themarshallproject.org/2026/01/06/trump-arrest-immigrants-private-prisons

https://finance.yahoo.com/news/3-reasons-geo-risky-1-040703366.html

https://en.wikipedia.org/wiki/Prison_divestment

https://www.govexec.com/workforce/2026/01/ice-more-doubled-its-workforce-2025/410461/

https://www.theguardian.com/us-news/2025/dec/31/ice-recruitment-media-campaign

https://www.axios.com/2025/02/13/trump-immigration-deportation-obstacles

https://www.reuters.com/world/us/avelo-end-us-deportation-flights-close-arizona-base-2026-01-07/

https://www.chron.com/culture/article/avelo-california-base-closes-20770582.php