Since Trump’s election win, CoreCivic up 67%, GEO Group up 44%. Trump’s announced mass detention-to-deportation policies fuel sharp stock gains for private prison corporations. Commodified human rights and freedoms become equity pressure points suppressing stocks. Investors and traders show confidence in anticipated windfall profits from new waves of mass detention.

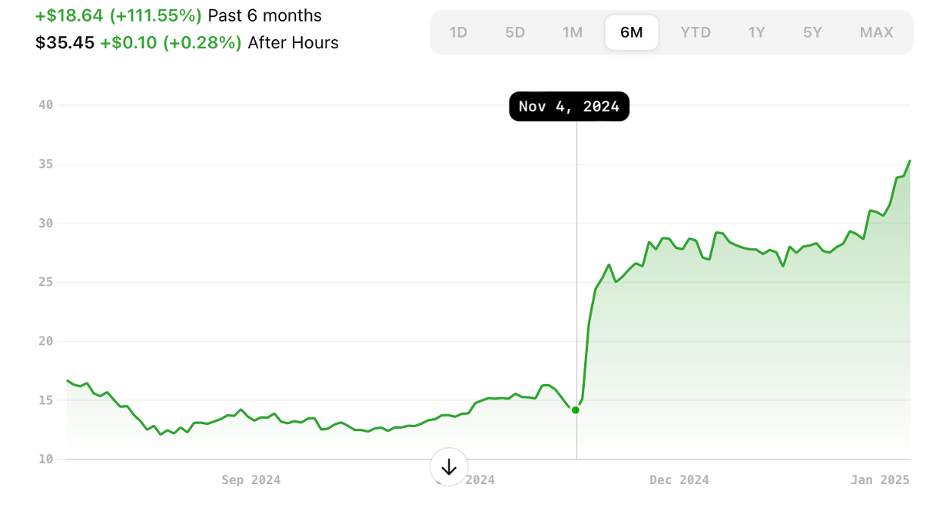

Nov 5, 2024: One day before Trump’s election win, GEO Group’s stock was at $14.18:

Nov. 5, 2024: Donald Trump was elected as the 47th President of the United States but Wall Street closes before election results are in. Stock is at $15.13.

By Nov 11, 2024, less than a week after Trump’s victory, a sharp spike that started within 24 hours of election drove GEO Group’s stock to $25.36:

Jan 19, 2025: One day before the inauguration of Trump, GEO Group’s stock trades for $35.35:

GEO Group’s Stock Rises 44% since Trump’s Election Victory

The GEO Group, Inc. is a leading private sector provider of correctional, detention, and community reentry services who operates facilities under contracts with federal agencies such as the U.S. Marshals Service, Immigration and Customs Enforcement (ICE), and the Federal Bureau of Prisons. GEO also has state-level contracts and provides community-based services such as electronic monitoring and residential reentry programs. The company is headquartered in Boca Raton, Florida.

Stock Performance Since Election: Following the 2024 U.S. Presidential Election on November 5, GEO Group’s stock skyrocketed, closing at $24.43 on Election Day and rising to $35.35 by January 18, 2025. This represents an increase of approximately 44.7%, largely driven by investor anticipation of stricter immigration enforcement and mass detention/deportation policies under the incoming Trump administration.

Economic Expectations: GEO Group’s financial expectations are tied to policy shifts favoring increased use of private detention facilities. With large-scale deportation plans and expanded immigration detention expected, the company stands to gain significantly. GEO has also historically aligned itself with conservative political leaders, contributing $225,000 to a pro-Trump super PAC in 2016 and maxing out donations to Trump’s 2024 campaign.

Controversies and Scandals

-

Labor Practices: In 2017, GEO faced a lawsuit in Washington State for paying immigrant detainees as little as $1 per day. A federal jury later ordered GEO to pay $23.2 million in back wages.

-

Health and Safety Violations: Lawsuits have alleged GEO exposed detainees to toxic chemicals at the Adelanto Detention Facility in California. This facility has also been criticized for inadequate COVID-19 protections.

-

Judicial Rebuke: A federal judge criticized GEO for its “abominable performance” in managing the Mesa Verde Detention Center during the pandemic.

Political Contributions and Influence: GEO Group’s political alignment with Trump’s administration has been a cornerstone of its strategy. In addition to its financial contributions, the company has actively lobbied for policies favoring privatized detention and incarceration.

CoreCivic Stock rises 67% since Trump Election Victory

CoreCivic, Inc., headquartered in Brentwood, Tennessee, is one of the largest private prison operators in the United States. The company manages state and federal correctional facilities, detention centers, and residential reentry programs. While it operates some ICE detention facilities, its focus is more diversified, spanning state-level prisons and federal contracts.

Stock Performance Since Election: On November 5, 2024, CoreCivic’s (CXW) stock closed at $13.63. By January 18, 2025, the stock had risen dramatically to $23.05, marking a 69% increase over the specified period from election to pre-inauguration. This surge is believed to be attributed to investor confidence in stricter incarceration policies under the Trump administration.

Legislatively, the Laken Riley Act mandates the detention of undocumented individuals suspected of even minor theft and expands state authority in immigration enforcement. This could increase the need for detention facilities, potentially benefiting companies like CoreCivic.

Additionally, Florida Governor Ron DeSantis has called a special legislative session to implement President-elect Trump’s immigration policies, including enhanced border security and mass deportations. Such state-level initiatives may further drive secondary demand for detention services benefitting CoreCivic.

In summary, CoreCivic’s stock surge is linked to anticipated policy changes under the incoming administration, which are expected to increase detention and incarceration rates, thereby boosting demand for private prison services.

Economic Expectations: CoreCivic’s financial prospects are closely linked to shifts in state and federal incarceration policies. The company’s diverse portfolio positions it to benefit from increases in prison populations, particularly in southern states where mass incarceration initiatives are often politically popular. CoreCivic has also contributed significantly to conservative campaigns and causes, further strengthening its ties to policy decisions favoring privatized incarceration.

Political Contributions and Influence: CoreCivic has historically supported conservative political leaders and policies. While its contributions are less explicitly tied to Trump than GEO’s, CoreCivic’s lobbying efforts and campaign donations have consistently aligned with private prison profits and increased mass incarceration.

Summary of Political Contributions to Trump and Expectations

GEO Group

-

Total Contributions to Trump (2024 Campaign): Maxed out at allowable donation limits.

-

Notable Contributions: $225,000 to pro-Trump PACs in 2016.

-

Economic Expectation: Anticipates increased detention from stricter immigration enforcement.

CoreCivic

-

Total Contributions: Significant but less directly tied to Trump compared to GEO.

-

Economic Expectation: Benefits from state and federal incarceration growth, particularly in southern states.

The GEO Group and CoreCivic are publicly traded companies, with their ownership distributed among numerous institutional investors. Major shareholders include BlackRock Advisors LLC and Vanguard Fiduciary Trust Co., which hold significant percentages of CoreCivic’s shares.

Old Friends

During Trump’s 2016 campaign, The GEO Group donated $225,000 to a pro-Trump Super PAC. Following his election, both The GEO Group and CoreCivic contributed $250,000 each to Trump’s Inaugural Committee.

Additionally, The GEO Group held its annual leadership conference at Trump National Doral, a golf resort owned by Trump, highlighting a business relationship beyond their industry operations.

These contributions and engagements suggest a closer relationship with Trump beyond merely operating in the same industry. Such interactions have raised discussions about the influence of private prison companies on public policy, especially during administrations favoring stricter immigration and law enforcement policies.

Past Controversies

The GEO Group and CoreCivic have faced numerous scandals and legal challenges over the years. In January 2025, the U.S. 9th Circuit Court of Appeals upheld a decision requiring GEO Group to pay over $23 million to the state of Washington and immigrant detainees who were paid $1 per day in a work program, ruling that GEO must comply with state minimum wage laws despite operating under a federal contract.

Similarly, CoreCivic settled a forced labor lawsuit in October 2023, where plaintiffs alleged they were compelled to work for as little as $1 per day under threat of punishment, including solitary confinement.

Both companies have been scrutinized for conditions in their facilities. In December 2024, a Tennessee inmate died and five others were injured after fights erupted at a CoreCivic-run state prison, highlighting ongoing safety concerns.

Additionally, in 2012, GEO Group settled a class-action lawsuit over conditions at the Walnut Grove Youth Correctional Facility in Mississippi, resulting in the state ending its contract with GEO and placing operations under a federal court monitor.

Financial institutions have also distanced themselves from these companies. By October 2020, major banks like Bank of America, Wells Fargo, and JPMorgan Chase announced they would no longer offer lines of credit and term loans to GEO Group and CoreCivic, following public outcry over their involvement in immigrant detention.

Despite these controversies, both companies have seen stock surges in anticipation of increased detentions under new immigration policies. Following the 2024 election, GEO Group’s shares increased by 35%, while CoreCivic’s stock rose by 27%, driven by expectations of expanded mass detention.

We will continue to follow this trend and will post updates on this page as they occur.

Original report prepared by IncarcerNation.com on 01/19/2025.